Did you know that March is Fraud Prevention Month AKA #FPM2015? To celebrate, I was invited to The Carbon Bar to eat frites and learn about Interac’s crafty fraud prevention ways.

To be honest, I was already a little biased before the evening began. You see, I had racked up a bit of credit card debt in my early twenties by being all hedonistic and stuff; Jäger bombs and online shopping sprees were all I knew. Now, in my late twenties, I have become more responsible with my hard earned cash money, and that includes no longer using credit cards in my day-to-day. Instead, I use my Interac Debit card for the majority of my purchases.

I’ve also had issues with credit card fraud in the past with two notable online retailers, so when it comes to any sort of online shopping, I’ve developed a firm ‘Interac-only’ household policy.

Here’s what I learned over the course of the informative (and very delicious) evening:

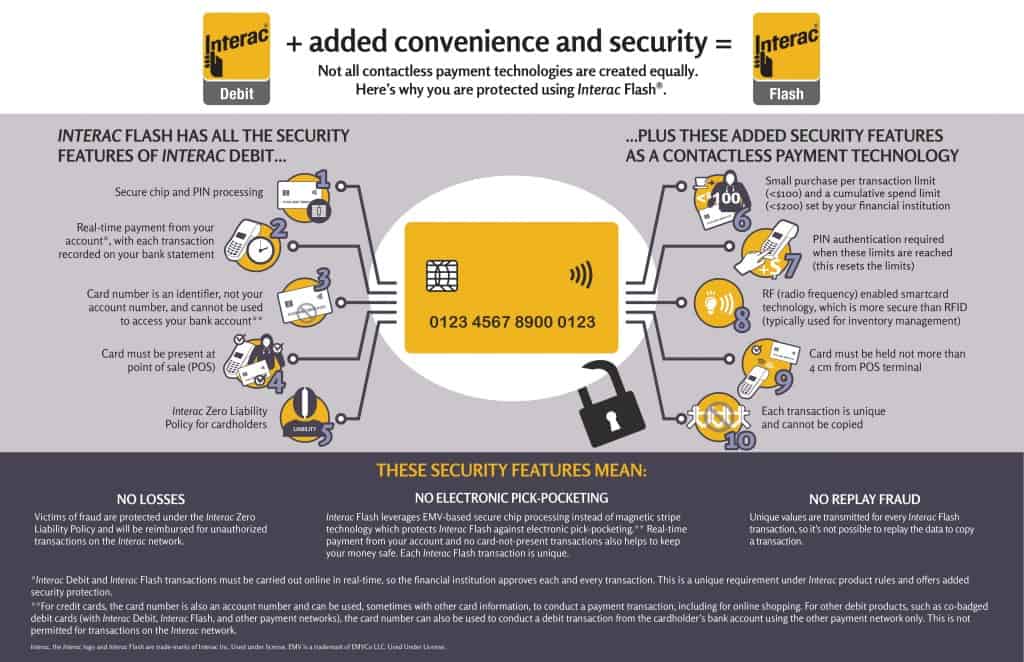

- Interac has a Zero Liability Policy, which means cardholders are protected against all losses. WOOT!

- Static information is a criminal’s wet dream. Change your pin often, girl!

- Interac Flash may be the greatest and most convenient invention of this century. Single Interac Flash purchases cannot exceed $100, and you can’t spend more than a total of $200 without being prompted to enter your pin, so you can SUCK IT, criminals!

- The Interac network has one of the lowest rates of fraud globally, and it keeps declining every year.

- When dining at The Carbon Bar, leave room for the banana toffee cream pie, or you’ll be filled with regret for the REST OF YOUR LIFE.

Watch the video below, then head over to interac.ca for more info!

Follow Us On Instagram

Follow Us On Instagram